Services

CDFAs™ work with clients that are either in the process of, or considering, a divorce and have anxiety about how they will pay all of their financial obligations, legal fees and continue to be independent.

When you retain our services we will meet in three to four 2½-hour consultations:

- Your first and possibly 2nd consult is an information gathering meeting where all of the documentation that you've been asked to gather will be input in our family law software.

- The second or third meeting will be to go over different options available to you and to review the projected impact of those options.

- The final meeting will be to present you with your final comprehensive divorce financial analysis. It will include up to three property settlement options that you can then use either together with your spouse, or with your attorney as you negotiate that part of your divorce.

Your Comprehensive Divorce Financial Analysis will include but is not limited to:

Budget Report - The Budget Report starts with gross employment income for each party, investment income, business income, and spousal maintenance and child support income.

It then accounts for monthly living expenses for the home, vehicles, children, personal, medical expenses that are not covered by insurance, and spousal maintenance and child support paid. Finally taxes including, Federal Withholding, FICA & Medicare are accounted for and totaled.

The end result is a clear picture of each person's after-tax cash flow.

Projected After-Tax Cash Flow - A picture is worth a thousand words. The Projected After-Tax Cash Flow is a graph showing future income trends which can accentuate any large disparity in day-to-day living.

Division of Marital Property - The Marital Property Division report shows each asset and debt, how it is divided, and the total value on an after-tax basis.

It show subtotals for "total assets" and "total debts." It also shows totals of liquid versus non-liquid investment assets and the total being kept by each party.

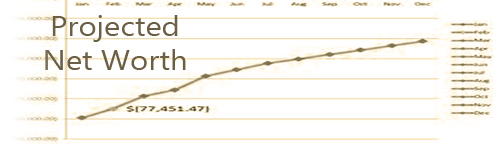

Projected Net Worth - The Projected Net Worth graph shows future growth projections of assets.

Liquidations to Cover Negative Cash Flow - The Liquidations to Cover Negative Cash Flow report shows which assets are being liquidated, how much of each asset is used to pay incremental tax, and how much is available to cover the deficit.

When liquidations are made taxes and penalties are taken into consideration.

Sale of Real Estate - When a residence is sold, the Sale of Real Estate report shows the net income from the sale, the estimated tax impact, and the after-tax net income from the sale, for both parties.